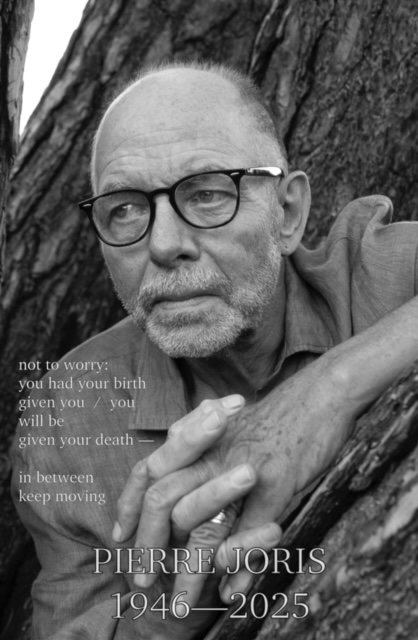

This text is published as part of a special b2o issue titled “Critique as Care”, edited by Norberto Gomez, Frankie Mastrangelo, Jonathan Nichols, and Paul Robertson, and published in honor of our b2o and b2 colleague and friend, the late David Golumbia.

Bitcoin Vitalism and the Elixir of Life

Adin E. Lears

At the 2021 Bitcoin convention in Miami, Michael Saylor, CEO of the business intelligence company MicroStrategy, lauded Bitcoin as a form of energy:

Bitcoin is a system for collecting, channeling, and storing energy in the most efficient way we’ve ever invented. It is storing potential energy to stay alive. You have fat on your body? If I cut you off from food for ninety days, you’d still be alive…When you’re putting energy into Bitcoin, you’re storing fat. Fat is organic energy. Bitcoin is monetary energy (Saylor qtd. Stephenson 2022: 33).[1]

Saylor seems to imagine Bitcoin here as an energy that is economic as well as biophysical: it is an energy that supports the condition of being alive. He seems to confuse the actual and the metaphorical, taking a metaphor—Bitcoin as energy—and treating it as an actuality—Bitcoin is life-energy. In doing so, he conflates the domains of the economic and the physical in a way that would seem to correlate material wealth with greater strength and longevity. There is a kind of vitalism to this thinking, which can be characterized as a belief that the foundations and processes of life are dependent on a force beyond the physical realm. What that force is—God? Money?—remains unclear.

Saylor’s vitalist and specifically physio-economic thought is the logical extension of a rationale for cryptocurrency writ large. Proponents of crypto believe that the US dollar has been devalued at the whim of an establishment of banking “elites,” effectively breaking down the strength and vigor of the US economic system. Saylor—and other proponents—believe Bitcoin offers a better, stronger alternative. It is a means of bringing economic control, autonomy, and “sovereignty” back to the people. Ultimately, as I will show, proponents like the economist Saifedean Ammous believe that this will bring about a social and cultural revitalization, improving the quality of art, ending war, and even restoring nutrients to the soil.

Tracing the ideologies of Bitcoin back to the formation of the John Birch Society in the 1960s, David Golumbia (2016: 14-16) has detailed how such an emphasis on freedom and individual sovereignty—among other techno-utopian promises—evinces a form of cyberlibertarianism particular to the alt-right. Here I find early quickenings of such vitalism in another techno- utopian pursuit driven by a desire for both economic and physical vigor: the alchemy of the European middle ages. Since its inception among ancient natural philosophers, alchemy sought to purify and vivify matter, turning base metal into gold and restoring youth with the elixir of life. Through the European middle ages, alchemical pursuits were often informed by the promise of alchemical knowledge as a means of restoring the perfection humans had lost as a result of the biblical Fall. For many of its proponents, Bitcoin offers a similar means of eluding the constraints of government and banking “elites” and revivifying a “fallen” culture. As Elizabeth Povinelli (2016: 20) reminds us, a spirit of vitalism undergirds capitalism writ large in its impulse to see in all things a volatile potential to create profit. Bitcoin’s vitalism literalizes this perspective, yoking an animist language of material communalism with processes of economic and social exploitation and extraction. Attending to this long history of economic vitalism allows us to look past the rationalist logic favored by proponents of Bitcoin to identify its quasi-mystical appeal.

Medieval Alchemy and the Elixir of Life

In recent decades, alchemy’s vitalism has been a vexed subject among historians of science, many of whom have sought to rescue alchemy from the realm of occult esotericism by accentuating its concern with physical materials, processes, and transformations. Indeed, the influence of early alchemical theories and practices on modern chemistry and pharmacology has been well-established (DeVun 2009; Chang 2011). Yet, as scholars like Leah DeVun (2009: 102-105) and Zachary Matus (2017: 7-14) have demonstrated, alchemy’s spirituality and materialism are mutually imbricated: its theology underpins its understanding of the material world and material practices drive its spiritual aims. It is hardly necessary to keep these two realms separate in the study of medieval alchemy. This is especially true in the realm of alchemy’s metaphors, which frequently draw from religious imagery and ideas in the process of describing alchemical materials and processes. As DeVun (2009; 102-28) argues, such spiritual metaphors reveal the complexly theological basis that underpins much medieval alchemy and, moreover, serve at least two rhetorical aims: first, to render abstract scientific processes in more widely comprehensible terms and second, to imbue alchemical programs with the heft of the spiritual, even revelatory. As we will see, in articulating the meaning and value of Bitcoin, its proponents walk a similar line, melding “hard” science with the spiritual affects and feelings of religious belief.

Medieval alchemy was, in a fundamental sense, a life science. It drew from Aristotelian natural philosophy and other intellectual traditions, seeking to create an elixir or “Philosophers’ Stone” that would purify metal and prolong human life. Medieval natural philosophers drew on the ideas of Arabic naturalists, who posited a “medicine” that would heal metals, turning them from base metal into gold and silver (DeVun 2009: 84). The original aim of alchemy was this transmutation of metal; the Arabic word al-iksīr, from which the word elixir derives, originally referred only to the perfection of metals (Matus 2017: 40-41). Yet medieval thinkers like the thirteenth-century English philosopher and Franciscan friar Roger Bacon (d. 1292), perhaps influenced by earlier Chinese Taoist ideas about the prolongation of human life, combined the aim of purifying or tempering metal with treating the human body (DeVun 2009: 84).

The relationship between the purification of metal to gold and the prolongation of human life was not a metaphor: the same alchemical principles governed each one. For early alchemists who sought to turn base metal into gold, all metallic matter was constituted by “primary qualities”—hot, dry, wet, or cold—which could be transformed through alchemy, along with the metal’s appearance. The primary quality of tin, for example, was dry. But this quality could be transformed into the heat attributed to gold or the cold attributed to silver, through the elixir. In this way, alchemy was believed to transform both the constitutive substance and the superficial appearance of metal. Yet these primary qualities—hot, dry, cold, and wet—constituted not only metal but elemental matter—fire, earth, air, and water. And these elements, in turn, comprised the humoral matter that made up the human body: yellow bile, black bile, blood, and phlegm. This material correspondence between matter and the human body enabled medieval thinkers to extend the logic of the elixir from the purification of metal to the prolongation of human life (Matus 2017: 40-41). Bacon, for example, held that all material substances, including both metals and flesh, were composed of elemental humors (Newman 1997: 319-23). The goal of alchemy was to encourage a state of what Bacon called “equal complexion”: to temper matter—metallic or fleshly—so that all of its elemental qualities or humors were in perfect balance (Newman 1997: 328-32).

Bacon’s theory of alchemical medicine offers a useful example of medieval alchemy’s techno utopianism: its aim to improve the state of the physical body, and also the value of the immaterial soul. The elixir had the capacity for moral as well as physical improvement. Bacon’s ideas on the possibility of achieving “equal complexion,” and with it the perfection of the body and soul, were grounded in biblical accounts of both prelapsarian corporeality and Pauline accounts of the resurrection of the body. In his Opus Majus, Bacon wrote:

For this condition [of immortality] will exist in our bodies after the resurrection. For an equality of elements in those bodies excludes corruption forever. For this equality is the ultimate end of the natural matter in mixed bodies, because it is the noblest state, and therefore in it the appetite of matter would cease, and would desire nothing beyond. The body of Adam did not possess elements in full equality, and therefore the contrary elements in him acted and were acted on, and consequently there was waste, and he required nourishment. For this reason, he was commanded not to eat the fruit of life. But since the elements in him approached equality, there was very little waste in him; and hence he was fit for immortality, which he could have secured if he had eaten always the fruit of the tree of life. For this fruit is thought to have elements approaching equality; and therefore it was able to continue incorruption in Adam, which would have happened if he had not sinned (DeVun 2009: 85-86).

Bacon stresses that the equal complexion of the resurrected body can be achieved on earth. He reasons that Adam’s prelapsarian body was subject to humoral imbalance that could be adjusted and equalized by consuming from the tree of life; if Adam had not sinned, consuming the tree of life might have sustained him forever. Significantly, Bacon equates alchemical “equal medicine” with the fruit of the tree of life: both possess material elements in perfect balance and both have the capacity to transfer this perfection to the body of Adam (Matus 2017: 44-46; Newman 1997: 325; DeVun 2009: 85-86). Here and across his corpus of work, Bacon stresses a direct relationship between sin and the physical body: sin caused the body to deteriorate and lose its life force; purification from sin could make the human body more vigorous and extend life. His aim was to use alchemy to turn the human body to a more pure state: a natural balance of equal complexion that approached immortality. In comparing the therapeutic effects of the alchemical elixir to the effects of the resurrection, Bacon reveals his aim to promote the perfection of heaven on earth (DeVun 2009: 86).

Indeed, for Bacon, alchemy was not simply a potent medicine. It also offered a means of converting the physical complexions and corresponding morals of non-Christians. In outlining alchemy’s purpose in this endeavor, Bacon drew on the purported advice from Aristotle to Alexander the Great presented in the pseudo-Aristotelian text the Secret of Secrets. Because various regions had their own complexions, which in turn influenced the physiology and morals of the people who dwelled there, the Secrets-author reasoned that changing the landscape would influence the bodies and minds of the inhabitants, “pacifying” them into submission. In the absence of details supplied in the Secret of Secrets, Bacon offered his alchemical elixir as a means of accomplishing this change in landscape, physiology, and moral make-up (Matus 2017: 49-52).

Bacon was not alone in his desire to draw the perfection of heaven into the earthly realm. Writing several decades after Bacon, the early fourteenth-century French Franciscan alchemist John of Rupicessa (b. 1310) elaborated on the alchemical theory of Bacon to articulate a “quintessence” that might extend life (DeVun 2009: 81-89). Rupicessa’s alchemical quintessence was based on a “fifth element,” drawn in part from Aristotelian and Stoic conceptions of the pneuma, or vital spirit pervading all things, which Rupicessa understood as a manifestation of heaven on earth (DeVun 2009: 67). Whereas the primary qualities of the four earthly elements were fixed—fire is hot and dry and cannot become cold or moist—Rupicessa held that the fifth element could shift in its quality when it is necessary, making it “strong against all opposing things” (DeVun 2009: 66). It was a kind of universal cure, adding any “quality” needed to balance the humoral complexion.

Like his predecessor, Roger Bacon, Rupicessa’s description of the process of the creation and operations of the quintessence sought the restoration of spiritual purity. He extended this ideal, by additionally emphasizing that such purification could be achieved through a distinctly human ingenuity. Describing the quintessence, Rupicessa wrote:

[T]hrough the virtue which God contributed to ornamented nature and subjected to human magisterium, man is able to cure the inconveniences of old age—which impeded the works of the Evangelical life too much among the ancient men of the gospel—and to restore the loss of youth and to recover the pristine powers and to have them again….This is what all who have worked to seek the thing created for the use of humans desire, to be able to protect the corruptible body from putrefaction and to conserve it without diminution so that it may be conserved, if it is possible, in perpetuity. This is the thing that all desire naturally: never to be corrupted, nor to die” (DeVun 2009: 65).

Though he does not frame the operation of the quintessence in terms of the biblical Fall, as Bacon does, Rupicessa’s account here nevertheless evinces a similar desire to “restore” and “recover” a “pristine power” that has been lost. Significantly, Rupicessa’s account emphasizes human exceptionalism as a foundation for scientific ingenuity. Nature has “virtue” (virtutem)—an early term for vital power or force. But this natural force is ultimately “subjected” to “human magisterium.” Such an emphasis on human power over nature implicitly recalls the prelapsarian condition of Genesis, in which God created Adam in his own image, giving him dominion over all other creatures (Genesis 1:26).

Rupicessa’s emphasis on restoring purity through human control over nature extends into his account of the materials of the quintessence. For Rupicessa, the quintessence should be made of:

something which is in itself incorruptible (if it exists in eternity), and which always makes anything that comes into unity with it uncorrupted, most of all flesh, something which nurses the virtue and spirit of life and augments and restores it; something which digests all rawness, and reduces all that has been digested to equality, and which removes from anything all excess of any quality and restores to it any lost quality (DeVun 2009: 66).

The elusive “something” Rupicessa seeks is a substance that is entirely original and sovereign; it is incorruptible “in itself,” i.e. through its own force or power, and not through something added. Its originary power allows it to exert a force that influences any matter it comes in contact with, including corruptible human flesh. Using a viscerally material metaphor of digestion, Rupicessa describes the work of the quintessence as a process of breaking human flesh down to an essence and adding back what has been lost. The originality of this substance—its purity and self-sufficiency—gestures to the ways that Rupicessa’s ideals of purity inform a related standard of sovereignty. His quintessence, in short, sought a substance of such purity and sovereign force that it could transfer such qualities to the human body and soul, restoring some of the perfection lost in the Fall.

Indeed, Rupicessa’s ideal of human sovereignty is particularly evident in his rationale for the quintessence, which emerged from the theory that humans suffered three kinds of death: natural death, violent death, and “death [that] arrives sooner than the end predetermined by God.” Medicine was fruitless against the first two. But the last kind was “because of too much regeneration and dissolution, or through too much austere abstinence or despair, or through negligence in avoiding danger of death, one kills oneself” (DeVun 2009: 64-65). In other words: Rupicessa’s third form of death was due to human error and failure to avoid danger. His quintessence sought to address this last kind of death. By acknowledging that some, not all, deaths could be prevented, Rupicessa maintained that supreme power lay in the hands of God. At the same time, he suggests a kind of human culpability for certain illness, corruption, and death, a premise undergirded by a belief in human free will. Medieval theologies of the Fall understood the postlapsarian condition as a state of spiritual slavery, defined by the sinful violation of divine law (Wyatt 2009: 248-49). Nevertheless, unlike animals, humans could exercise free will, enabling them to attain a certain freedom, even in their sinful lapsed state (Shannon 2013: 135-41; Davis 2016: 158-60). By situating his quintessence as a remedy for “bad” human choices, Rupicessa reinforces the theology of the Fall as a crucial cornerstone of his alchemical theory. Eschewing foundational religious ideals of poverty, humility, and charity, such theory weaves the alchemical pursuit of longevity with a desire for a sovereign self-sufficiency and control.

Indeed, such individualism informed Rupicessa’s political program for the quintessence. As DeVun has shown, Rupicessa’s “apocalyptic alchemy” was informed and made urgent by a millenarian mindset that predicted the imminent arrival of the Antichrist (DeVun 2009: 57). His quintessence promised to bolster the strength of the institutional Church at multiple levels. The alchemical production of precious metals could be used to buy necessities for Christians, and therefore contribute to funding the Church’s war against the Antichrist (DeVun 2009: 58). At the same time, alchemy’s medicinal uses could help to heal the bodily injuries resulting from that war; stronger human bodies would in turn mean longer-lived evangelizing, more powerful adversaries for the Antichrist and allies for the Church (DeVun 2009: 61-62). In this way, Rupicessa’s religious beliefs and ideals were fundamental to his alchemical theories and aims. Attending to the convergence of spiritual and material registers in medieval alchemy can amplify its emphasis on physical and moral purification, as well as human ingenuity and mastery over the natural world—all ideas that also emerge in the vitalism that undergirds much contemporary discourse on Bitcoin.

Bitcoin Vitalism

As Golumbia (2016: 14-16) has shown, the conspiratorial affects and cyberlibertarian ideals around Bitcoin arguably found their origins in the paranoid economic theory popularized by the John Birch Society, whose founder Robert Welch was among the first to give voice to notions of economic control by government and banking elites. Welch’s essay, “The Truth in Time” (1966) framed social welfare programs—many of them emerging directly from the New Deal—as a means of reducing the responsibility and thus autonomy of individual citizens while building the authority and reach of the federal government. Other John Birch Society publications outlined how the US Federal Reserve has devalued the US dollar while maintaining sole control over the issuance of bank notes. Bitcoin’s emergence as a “decentralized” or “distributed” economic system responds in part to this paranoia about government control over banking. The software does not exist in a single physical location, nor is it hosted by a single company like Amazon or Google. It is, instead, networked across multiple machines. For these reasons, proponents of Bitcoin have lauded it as a form of “distributed authority” which places economic power back in the hands of ordinary people rather than banking elites. Yet, as Golumbia shows, this idea of distributed authority masks a commitment to the sovereign individuality of Bitcoin’s users, who remain free from government regulation and interference (Golumbia 2016: 27-32; 2024: 281-96).

These alt-right impulses toward freedom and individual sovereignty masked in an anti-authority, even quasi-communalist ethos are evident in Bitcoin’s vitalist currents. In his book, The Bitcoin Standard (2018: 75-76), the economist Saifdean Ammous argued that, as a sound money system less subject to the fluctuations in value emerging from fiat-systems, Bitcoin could cultivate the low time preference that he believes is essential for a flourishing human culture. For Ammous, those with low time preference are more apt to think about the future; they are more likely to delay gratification and invest, thereby yielding higher returns on their investments. In contrast, those with a high time preference tend to live in the moment, seeking instant gratification. For Ammous, this is the prevailing economic atmosphere today, a form of Keynesian economics centered on “a creed of consumption and spending to satisfy immediate wants.” He continues:

By constantly expanding the money supply, central banks’ monetary policy makes saving and investment less attractive and thus it encourages people to save less and invest less while consuming more. The real impact of this is the widespread culture of conspicuous consumption, where people live their lives to buy ever-larger quantities of crap they do not need…The financial decisions of people also reflect on all other aspects of their personality, engendering a high time preference in all aspects of life: depreciating currency causes less saving, more borrowing, more short-termism in economic production and in artistic and cultural endeavors, and perhaps most damagingly, the depletion of the soil of its nutrients, leading to ever-lower levels of nutrients in food (141).

The baggy environmentalism of this passage—Ammous loosely links overconsumption of resources to depletion of nutrients in the earth’s soil, without explaining the relationship—amplifies a vitalist current in Ammous’s thinking: as a sound money system, Bitcoin can repair cultural and environmental devitalization.[2] More pointedly, the logic of the passage moves seamlessly from economic value to cultural value to organic value: an inability or failure to accumulate wealth dilutes cultural production to cheap “crap,” which in turn diminishes nutrients from the soil. Humans are not living up to our full potential, Ammous implies. Our civilization is watered down and as a result, the environment around us is failing to support our basic needs. We may not even be fully human anymore, since, as Ammous makes clear in an earlier passage, animals have a higher time preference than humans (74).

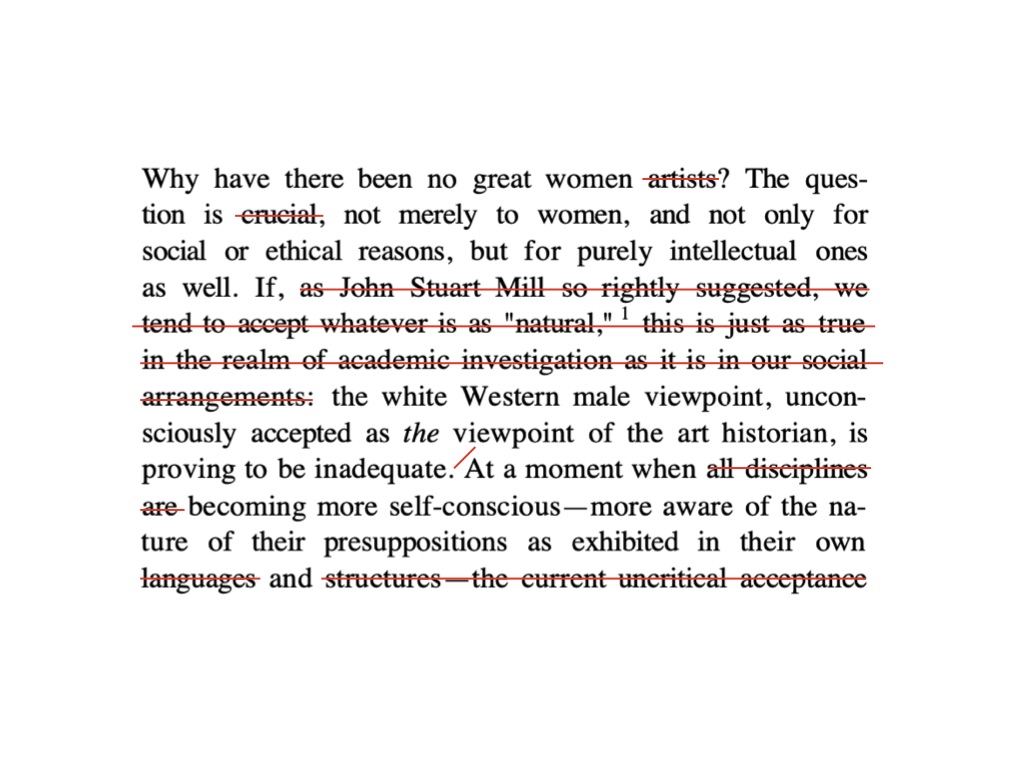

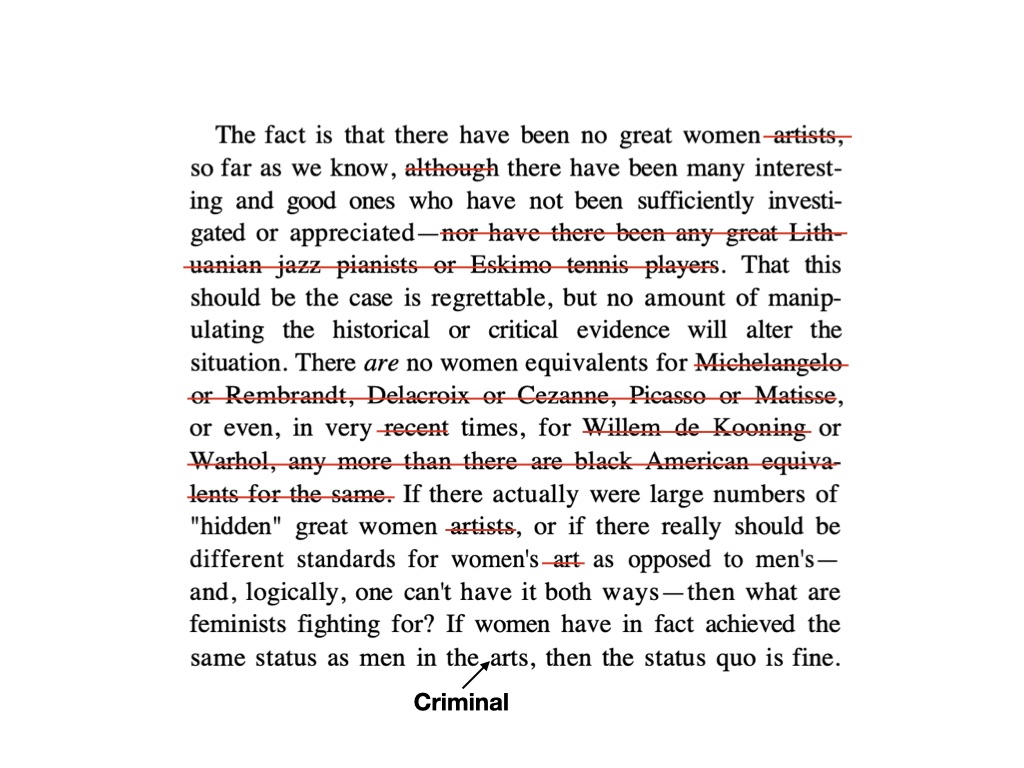

Indeed, Ammous’s logic of devolution implies a desire to return to a more pure, vigorous, and human state of being, proposing that Bitcoin offers a means for such a return. He writes at length on the “artistic flourishing” of Europe under systems of sound money, juxtaposing the work of Bach and Beethoven with the “animalistic noises” produced in contemporary recording studios, which turn a profit by “selling to man the titillation of his basest instincts.” A prior “golden era” produced music that “spoke to man’s soul and awakened him to think of higher callings than the mundane grind of daily life.” In contrast, “today’s musical noises speak to man’s most base animalistic instincts, distracting him from the realities of life by inviting him to indulge in immediate sensory pleasures (99).” Similarly, Michelangelo spent four years painting the Sistine Chapel, eating very little in order to perfect his craft. Modern art—Ammous has a particular disdain for Rothko—could have been made in several hours by “a bored six-year-old” (100). Today’s art is animalistic and childish, a devolution from the mature vigor of the past. With tremendous self-control, the great artists of prior centuries eschewed base materialism, holding their minds on the higher spiritual realm of beauty and “refined tast[e]” (101). For Ammous, Bitcoin approaches a social ethic, through which human culture can return to a thriving and peaceful state—his discussion of sound money and individual freedom makes a claim that unsound money creates the conditions for “perpetual war” (145-49). Yet it is a vision not of mutual aid, but of individual self-sufficiency. The purity implied in his logic of devolution—the “return” to material potency in both high value cultural production and greater health—underscores Ammous’s claim that sound money generates the individual freedom and self-governance that undergirds an idealized golden age of high culture.

There is a fascistic impulse to these ideals of purity and self-governance—one that becomes apparent as we consider the strange aesthetics and materialism that emerges in the use of another blockchain technology: non-fungible tokens (NFTs), a digital identifier recorded on blockchain, which typically compiles visual and audio digital files into a kind of collage of digital art. As Arne De Boever (2021) has shown, NFTs enact a strange transfiguration of value that reinforces a fetishistic affirmation of the sovereign individual, even as it purports to distribute authority. With their emphasis on the creation of art in a digital space through copies of previously existing works, NFTs have been lauded as a more “democratic” art form, unmoored from categories like authorship, ownership, and value that tie art to the market. Yet, as De Boever argues, NFTs reinforce the very categories of authenticity, creativity, and eternal value they seem to refute, buttressing an “aesthetic exceptionalism” that accentuates the singular, even transcendent qualities of the work of art and the artist. The value of NFTs is so exceptional, in fact, that the material work of art does not matter. Rather than physical objects of art, buyers of NFTs receive “cultic objects”—a token, a certificate, even a clump of hair—to signify their ownership. Such objects refer obsessively to the gross materiality of the human body. Buyers of work by the NFT artist known as Beeple, whose art sold for a record $69,346,250 at Christies in 2021, receive a small token with a cloth, which can be used to clean the token, or “to clean yourself up after blasting a hot load in yer pants.” De Boever calls this “alt-right materialis[m]” a kind of trolling assertion of excess and often sexualized materiality to mask the immateriality of the NFT. The vitalist currents that circulate through Bitcoin discourse are another example of such alt-right materialism. Though such gross tokens are a far cry from the high culture promised by Ammous, both ultimately reinforce individual sovereignty through ideals of aesthetic exceptionalism. And they hide their immaterial nature with a persistent emphasis on matter: the stuff of the human body and the living earth.

The vitalism and alt-right materialism that is implicit in Ammous’s purist vision of Bitcoin becomes far more explicit in Michael Saylor’s insistent assertion that Bitcoin is energy. In an interview with Robert Breedlove, the influencer and host of the Bitcoin-promoting “What is Money?” podcast, Saylor compares Bitcoin to other digitally networked systems like Apple, Google, and Facebook. Once they reach a certain point of economic development, these corporations are “fires that have been unleashed into society…and the effect is exothermal.”[3] He goes on:

We have the collapse, the dematerialization of some product or service or virtue or some ineffable quality, be it friendship, or mobile devices, or information. It’s collapsing into a lower energy state. And as it collapses into a lower-energy state, huge amounts of energy in the form of profit, cash flow, and value, get given off….Facebook can improve the way you communicate to your loved ones overnight for a nickel…[W]hen you have these massive dematerializations of value and they get on a network with a network effect, it’s almost like… a crystallizing structure: you’ve got an amorphous substance and as it crystalizes we go from steam to water to ice. It collapses, it gives off energy. [Bitcoin] is that first digital monetary system: it’s collapsing into a much more efficient form; it’s giving off energy. And that just brings us back to the entire subject of how important is energy to the human race.

Saylor moves freely between descriptive and analogical modes here with a rhetorical style suitable to a venue promoting itself as “a podcast about Wisdom, Intelligence and Meaning” and “one of the most powerful philosophy podcasts in the world.” The effect is to muddle the relationship between the literal and the metaphorical, so that the analogy of Bitcoin as geothermal energy lends a vital physicality to an abstract monetary process: Bitcoin “gives off energy.” This confusion of the literal and the metaphorical is a rhetorical extension of the alt-right materialism that DeBoever identifies in NFT tokens. Just as the gross and often sexualized materiality of the token stands in for the fact that there is no material piece of art, Saylor’s Bitcoin vitalism occludes the immateriality of the currency. The stakes are higher with Saylor, however. The cultic fetish objects that stand in for NFTs make no claim they will help extend life (indeed, while their common references to masturbatory climax suggest virility, it also implies an expense of life force). For Saylor, Bitcoin can make a claim to such longevity.

The animating energy Saylor attributes to Bitcoin suffuses it with agency: later in his interview with Breedlove, Saylor describes how monetary energy “leaps from gold to Bitcoin” and “leaps from fiat to Bitcoin.” Humans can harness this energy for their own ends. Saylor explains “Money is the highest form of energy that human beings can channel. So if I went back through time, human beings as a species prosper by channeling energy. When we mastered fire, we channeled chemical energy. When we mastered missiles, we channeled kinetic energy…” Adopting Bitcoin is the next phase in human technological development necessary to prosper as a species. Like Frankenstein’s monster, the paradigmatic “creature” or “created thing” animated through the genius of human ingenuity, Bitcoin has come alive. And Saylor seeks to harness its life force.

Indeed, Saylor inadvertently places himself within a Shelleyan historical and literary genealogy of animated technology, invoking the corporation as a creature. In an interview with the Austrian podcaster and Bitcoin enthusiast Robin Seyr, Saylor responds to a question Seyr poses about what a future might look like under a Bitcoin standard:

I think, if you look at economic creatures, the classic economic creature in modern society is the corporation. The average life expectancy of the corporation is something like ten years…The number of corporations that are more than a hundred years old [trails off]. What percentage of people live to be more than a hundred, like .1 percent or .01 percent? What percent of corporations live to be more than a hundred, .0001 percent. Well, what if I told you I could make your company live forever?

In his comparison between the corporation and the “creature,” and in his attention to the lifespan of the corporation, Saylor’s response amplifies the etymological root of “corporation” in the post-classical Latin corporare: “to form into a body.” In doing so, it frames Bitcoin as a kind of vital medicine that can heal and protect the corporation, extending its lifespan to previously unseen proportions. Significantly, Saylor moves back and forth between corporate endurance and human longevity. His explicit claim is that the animating force of Bitcoin can invigorate corporations, making them “live forever.” But submerged within his response is the implicit claim that such economic energy might extend the human lifespan as well.

The logistics of Bitcoin’s capacity to improve human lifespan are unclear, beyond the simple fact that a currency perceived to build wealth might also offer more resources to live longer—better food, exercise, and healthcare, to name a few. But Saylor never substantively acknowledges the effects of economic imparity. He asks vaguely, “What’s the difference between perfect money and imperfect money?” And responds “Perfect money is economic immortality. Imperfect money is: we all have a short, brutal life.” He juxtaposes “people living in skyscrapers on the 80th floor” with “people in Africa living in mud huts.” His answers set aside any concern for the ways Bitcoin might offer practical material improvement for economic imbalances, nor does he make any attempt to understand the culturally-specific context of such conditions, in Africa or elsewhere. Instead, he is animated by a zealous drive for human improvement. Bitcoin as a new phase in human development, one in which science has realized aims that had previously been consigned to the realm of thought alone—the domain of art and religion:

Projecting economic energy through time and space has really been more of an aspirational fantasy…or an art than it was ever a science or engineering discipline. Bitcoin takes something from the artistic and from the religious and from the political domain and it moves it into the engineering domain where now there is actually a precise way to move capital…How will the world change? Profoundly [shrug]. I can create an AI that can live in cyberspace capitalized by Bitcoin that will live forever, that will have economic immortality that is completely sovereign from a company, a person, a country. That AI could, in theory split itself…spawn ten million more AIs that are all sovereign. It’s a life form….I could endow a university or nonprofit with Bitcoin that could conceivably last a thousand years without anybody working for it….I can create a company with a likely life expectancy of one hundred or five hundred or a thousand years.

Here is Saylor’s clearest turn to rhetorical alt-right materialism. By proposing that Bitcoin will materialize what has previously been consigned to the realms of art and religion, he makes literal the ideas that have dwelled in the domain of imaginative speculation and spiritual faith, sealing them with the certainty of science. In doing so, he proposes a future out of science fiction itself, one in which a new and sovereign life form is capable of spawning itself into an infinite number of other sovereign beings: a chilling vision of sovereignty on steroids.

Conclusion

I have argued that attending to the ways science and technology was—and is—imbricated with certain religious and spiritual affects amplifies the political ideals—freedom, individualism, sovereignty—behind both. Without drawing a direct line of influence between medieval alchemy and contemporary Bitcoin, I have shown how they are similar techno-utopian projects, seeking to use advances in science and technology to “perfect” society, or to bring about a utopian ideal. What is clear from the alchemical theory of Bacon and Rupicessa is that the purifying impulses of medieval alchemy could be used in the service of assuring Christian dominion: a totalizing project demanding the power of the one—the sovereign individual, nation, or faith—over the rest. Bitcoin poses a similar threat.

Alchemy was a contested subject and practice in the middle ages. Some of its critics saw it as a form of counterfeiting: if false gold entered economic circulation it could lead real gold to lose its value in the marketplace. Others took a more theological view, asserting that alchemy was a dangerous improvement on God’s creation by hubristic scientists too focused on earthly power and authority (Newman 2004: 34-114; Principe 2012: 59-60). In his under-appreciated Canterbury tale, The Canon’s Yeoman’s Tale, Geoffrey Chaucer (d. 1400), offered a powerful critique of the wasting effects of alchemical labor in fruitless pursuit of the Philosophers’ Stone. The tale is, in part, a fictional autobiography or confession from the perspective of an apprentice alchemist on the verge of shucking the ideals of mastery that have been hammered into him by a domineering master alchemist (Lears 2024). In one passage, the Yeoman describes how

He [the Philosophers’ Stone] hath ymaad us [the alchemists] spenden muchel good,

For sorwe of which almoost we wexen wood,

But that good hope crepeth in oure herte,

Supposynge evere though we sore smerte,

To be releeved by hym afterward.

Swich supposyng and hope is sharp and hard;

I warne yow wel, it is to seken evere.

That future temps hath maad men to dissevere,

In trust therof, from al that evere they hadde (Chaucer 2008: 274).

The passage vividly attests to the “sharp” and “hard” feeling of hope as the yeomen alchemists invest both their money and their bodies in the pursuit of the Philosophers’ Stone. Such desperate labor has affected them both physically and spiritually in their loss of “good”—both material goods and the more abstract quality that comprises what is good about them. The allure of “future temps”—of some promise of wealth or happiness—has resulted in the laborers’ separation from “al that ever they hadde.”

Chaucer wrote in a time of great social and civil unrest, as England was still recovering from the ravages of the plague and the economic and social transformations it had wrought. The enchanted promise of gold is keenly alive in the Yeoman’s tale; and Chaucer is sensitive to it. He acknowledges both alchemy’s promise of happiness and the ways that the pursuit of such happiness creates the very conditions the Yeoman seeks to escape: the feelings of a life dulled by work, of being used up. The mystical promise of medieval alchemy was a very real and human response to the material conditions of living in the European middle ages. As Zachary Matus has argued, alchemy was an extension of the emphasis on embodied and affective experience that suffused late-medieval religiosity (Matus 2017: 8-9). The blood of the suffering and dying body of Christ was a reminder of one’s own fleshly vulnerability and, for many alchemists, a potent symbol of the everlasting life they sought through the elixir (DeVun 2009: 116-27).

Behind the rationalist quasi-logic of Bitcoin is a similar mystical appeal. At the time of writing this essay, the Crypto platform Kraken was running an ad during Premier League soccer coverage, comparing Bitcoin to “digital gold” and promising that “it can never be counterfeited,” and that “no one can decide to just print more or shut it down.” The ad concludes with the image of a hand holding a golden ball of light, currents of buzzing electricity coursing from it, against the claim: “it puts the power back in all our hands.” In our current moment, as market-oriented government, economic, and healthcare institutions bear down upon us, foreclosing our capacity to thrive, who wouldn’t want such autonomy—for themselves and for everyone? The ad promises both.

The appeal of Bitcoin and other cryptocurrencies and blockchain-based technologies has weathered a host of controversies since Bitcoin’s inauguration in 2009. Its ascendancy appears to be all but assured, particularly after the 2024 election of Donald Trump. David Golumbia’s critiques of the alt-right origins and ideals of Bitcoin offer a powerful and real model of critique as care. Attending to the mystical aspects of Bitcoin’s appeal is, I hope, an extension of this impulse—one that seeks to identify not only the dangers of Bitcoin and its misleading rhetoric, but also to look deeper, probing the dangerously wounded spirit at its core.

I thank the editors and guest editors at b2o for including me in this special issue on “Critique as Care” in honor of my friend and colleague David Golumbia. Special thanks must go to the memory of David himself, who first made me believe I might have something to say about Bitcoin and alchemy. This essay is for him.

Adin E. Lears is the author of World of Echo: Noise and Knowing in Late-Medieval England (Cornell, 2020) as well as articles and essays on medieval embodiment and poetics and their implications for thinking about contemporary life. Her current book project offers a premodern history of life force and its social and literary effects in post-plague England. She is an Associate Professor at Virginia Commonwealth University.

References

Ammous, Saifedean. 2018. The Bitcoin Standard: The Decentralized Alternative to Central Banking. Hoboken, NJ: John Wiley and Sons.

Breedlove, Robert. “Michael Saylor: Bitcoin, Energy, and Humanity.” Swan Bitcoin. https://www.youtube.com/watch?v=07nAJvGoU9g&t=160s (accessed February 25, 2025).

____. “Robert Breedlove.” https://www.youtube.com/@RobertBreedlove22 (accessed February 25, 2025).

Chang, Ku-Ming. 2011. “Alchemy as Studies of Life and Matter: Reconsidering the Place of Vitalism in Early Modern Chymistry.” Isis 102, no. 2: 322-29.

Chaucer, Geoffrey. 2008. “The Canon’s Yeoman’s Tale” in The Riverside Chaucer, gen. ed. Larry D. Benson, 3rd ed. Oxford: Oxford University Press. 272-81.

Davis, Rebecca. 2016. Piers Plowman and the Books of Nature. Oxford: Oxford University Press.

De Boever, Arne. 2021. “The End of Art (Once Again).” boundary 2. https://www.boundary2.org/2021/03/arne-de-boever-the-end-of-art-once-again/ (accessed February 25, 2025).

DeVun, Leah. 2009. Prophesy, Alchemy, and the End of Time: John of Rupicessa in the Late Middle Ages. New York: Columbia University Press.

Golumbia, David. 2016. The Politics of Bitcoin: Software as Right-Wing Extremism. Minneapolis: University of Minnesota Press.

____, 2024. Cyberlibertarianism: The Right-Wing Politics of Digital Technology (Minneapolis: University of Minnesota Press.

Huestis, Samuel. 2023. “Cryptocurrency’s Energy Consumption Problem.” Rocky Mountain Institute. https://rmi.org/cryptocurrencys-energy-consumption-problem/ (accessed February 25, 2025).

Kraken Crypto Exchange. “See What Bitcoin Can Be.” https://www.youtube.com/watch?v=W4YkblM3McM (accessed February 25, 2025).

Lears, Adin E. 2024. “Corruption, Consumption, and Chaucer’s Reenchantment of Craft in the Canon’s Yeoman’s Tale.” Studies in the Age of Chaucer 46: 37-65

Matus, Zachary. 2017. Franciscans and the Elixir of Life: Religion and Science in the Late Middle Ages. Philadelphia: University of Pennsylvania Press.

Middle English Dictionary, s.v. “god n.2,” https://quod.lib.umich.edu/m/middle-english-dictionary/dictionary/MED18946/track?counter=4&search_id=173783 (accessed February 25, 2025).

Newman, William R. 1997. “An Overview of Roger Bacon’s Alchemy.” In Roger Bacon and the Sciences: Commemorative Essays, edited by Jeremiah Hackett, 317-36. Leiden, NL: Brill.

____. 2004. Promethean Ambitions: Alchemy and the Quest to Perfect Nature. Chicago: University of Chicago Press.

Oxford English Dictionary, s.v. “creature (n.),” December 2024, https://doi.org/10.1093/OED/8061309761.

Oxford English Dictionary, s.v. “corporation (n.),” December 2024, https://doi.org/10.1093/OED/1200365536.

Povinelli, Elizabeth. 2016. Geontologies: A Requiem to Late Capitalism. Durham, NC: Duke University Press.

Principe, Lawrence M. 2012. The Secrets of Alchemy. Chicago: University of Chicago Press.

Seyr, Robin. “Michael Saylor: ‘Bitcoin is Economic Immortality’.” https://www.youtube.com/watch?v=A60jVnAIX40 (accessed February 25, 2025).

Shannon, Laurie. 2013. The Accommodated Animal: Cosmopolity in Shakespeare. Chicago: University of Chicago Press.

Stephenson, Will. 2022. “Cryptonomicon: Among the Bitcoin Maximalists.” Harpers Magazine 344, no. 2062: 25-34.

Wyatt, David. 2009. Slaves and Warriors in Medieval Britain and Ireland, 800-1200. Leiden, NL: Brill.

1 There is, of course, an irony to the idea that Bitcoin might be a boon to the environment. Energy consumption is a leading cause of the current climate crisis and in 2023, Bitcoin alone (setting aside other cryptocurrencies) was estimated to consume 127 terawatt hours per year; more than many developed nations (Huestis 2023).

2 Quotations from Saylor have been lightly edited for clarity and to avoid repetition.